Content

All accounts also can be debited or credited depending on what transaction has taken place. Some balance sheet items have corresponding “contra” accounts, with negative balances, that offset them. Examples are accumulated depreciation against equipment, and allowance for bad debts against accounts receivable. United States GAAP utilizes the term contra for specific accounts only and does not recognize the second half of a transaction as a contra, thus the term is restricted to accounts that are related. For example, sales returns and allowance and sales discounts are contra revenues with respect to sales, as the balance of each contra is the opposite of sales . To understand the actual value of sales, one must net the contras against sales, which gives rise to the term net sales .

Sometimes the balances in the two accounts are merged for presentation purposes, so that only a net amount is presented. If the related account is an asset account, then a contra asset account is used to offset it with a credit balance. If the related account is a liability account, then a contra liability account is used to offset it with a debit balance. Thus, the natural balance what is a contra asset account of a contra account is always the opposite of the account with which it is paired. The two common contra liability accounts, discount on bonds payable and discount on notes payable, carry normal debit balances. The discount on bonds payable represents the difference between the amount of cash a company receives when issuing a bond and the value of the bond at maturity.

Requirements Of Contra Asset Accounts:

Money serves as a medium of exchange, or a thing that buyers exchange with sellers for goods, in the economy. In this lesson, explore the function of money, learn how it works in economic contexts, and review a few examples. The following information is available from the financial records of X Company. The sales allowance shows the discounts given to customers when returning the product. This is done to entice customers to keep products instead of returning them.

- “Daybooks” or journals are used to list every single transaction that took place during the day, and the list is totalled at the end of the day.

- These include accumulated depreciation, accumulated amortization, allowance for receivables, obsolete inventory, and discount on notes receivables.

- But the customer typically does not see this side of the transaction.

- You can estimate the total to record in the allowance for doubtful accounts based on uncollectible revenue totals from the previous year or you can conservatively estimate the amount.

If your factory equipment represents a $1.7 million asset but it’s depreciated by $700,000, you’d record the depreciation in a contra asset account. Comparing the two gives you the book value of $1 million on the equipment. Contra asset accounts are necessary for companies for various reasons. The most prominent of these include allowing companies to present a more accurate picture of their assets.

What Is A Contra Asset?

Other contra account examples can be Allowance for Doubtful Accounts , Bond discounts, which represent contra liability account, i.e. decrease bond payable account. On the other hand, is a contra liability account to mortgage payable that reduces the mortgage payable for long-term debt only. Contra accounts are also called valuation allowances because they are used to adjust the carrying value of the related asset or liability. The amount in the accumulated depreciation account is deducted from the assets of a company, such as buildings, vehicles and equipment.

Inventory Write-Off Definition – Accounting – Investopedia

Inventory Write-Off Definition – Accounting.

Posted: Sun, 26 Mar 2017 04:42:40 GMT [source]

Notes payable represents a liability created when a company signs a written agreement to borrow a specific amount of money. The lender may offer the company a discount if it repays the note early.

Start Your Business

Discount On Bonds PayableDiscount on bonds payable is the markdown value of a bond’s coupon rate or selling price compared to its market interest rate or fair value. BondsBonds refer to the debt instruments issued by governments or corporations to acquire investors’ funds for a certain period. Harold Averkamp has worked as a university accounting instructor, accountant, and consultant for more than 25 years. $100,000 – $5,000 (the 5% allowance for doubtful accounts) to equal a net receivable amount of $95,000.

Now let’s focus our attention on the two most common contra assets – accumulated depreciation and allowance for doubtful accounts. The process of using debits and credits creates a ledger format that resembles the letter “T”. The term “T-account” is accounting jargon for a “ledger account” and is often used when discussing bookkeeping. The reason that a ledger account is often referred to as a T-account is due to the way the account is physically drawn on paper (representing a “T”). The left column is for debit entries, while the right column is for credit entries.

Reserve For Obsolete Inventory

It represents the amount of money due to the company that you don’t think you’ll be able to collect. The accounting entries for a discount on notes receivables are as follows. Accounting Accounting software helps manage payable and receivable accounts, general ledgers, payroll and other accounting activities. This transaction records when a customer returns the paid goods, and a refund needs to be given. Within equity, an example of a contra account is the treasury stock account; it is a deduction from equity, because it represents the amount paid by a corporation to buy back its stock.

Business law encompasses all legal aspects of running a business, including employment law and contract law. Explore a definition and overview of business law, including the rules of starting, buying, managing, and closing a business.

Accounting

This loss is treated as an ordinary business expense and is deducted from the asset’s balance. Contra asset accounts also provide a clear picture of the accumulation of assets the companies have. Similarly, these accounts can also be essential in various calculations. As mentioned, companies do not represent these accounts on the balance sheet. However, they will still appear on the notes to the financial statements with necessary disclosures. The contra asset account, accumulated depreciation, is always a credit balance.

Where does bad debt written off go?

A bad debt write-off adds to the Balance sheet account, Allowance for doubtful accounts. And this, in turn, is subtracted from the Balance sheet Current assets category Accounts receivable. The result appears as Net Accounts receivable.

Accumulated depreciation is the total amount of depreciation expense allocated to a specific asset since the asset was put into use. Examples include trust accounts, debenture, mortgage loans and more. The first known recorded use of the terms is Venetian Luca Pacioli’s 1494 work, Summa de Arithmetica, Geometria, Proportioni et Proportionalita . Pacioli devoted one section of his book to documenting and describing the double-entry bookkeeping system in use during the Renaissance by Venetian merchants, traders and bankers.

What Is Contra Asset Account?

However, there are some prevalent contra asset accounts that may exist for all companies. Accumulated depletion is similar to accumulated depreciation but takes into account the total amount depleted from natural resources.

- By reporting contra accounts on the balance sheet, users can learn even more information about the company than if the equipment was just reported at its net amount.

- Account adjustments are entries out of internal transactions within a business, which are entered into the general journal at the end of an accounting period.

- Because contra assets simply detract from the total value of the asset account, all one has to do is add up all the assets together first.

- A debit to one account can be balanced by more than one credit to other accounts, and vice versa.

- The amount on the equity contra account is deducted from the value of the total number of outstanding shares listed on a company’s balance sheet.

A contra asset account is an account that opposes the balances of other asset accounts. As mentioned, a company will usually have debit balances in its asset accounts.

Because many examples of contra accounts are dealing with projected losses and not definite ones, it’s tempting to fudge and underestimate the contra amounts so as to make your company look healthier. This is a common issue when companies undergo audits, as auditors usually worry more about adequate contra reserves than how good the company’s bottom line looks. Also, with IFRS asking to report it in a particular way, the accountants must be updated with recent changes as to how the contra assets account should appear in the books of accounts. The proper size of a contra asset account can be the subject of considerable discussion between a company controller and the company’s auditors. The auditors want to ensure that reserves are adequate, while the controller is more inclined to keep reserves low in order to increase the reported profit level.

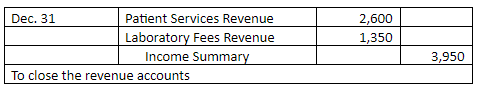

Therefore, in the allowance method, relevant bad debt expense is recorded and accounts receivable are written off when these are considered not recoverable. When the amount recorded in the contra revenue accounts is subtracted from the amount of gross revenue, it equals the net revenue of a company. In case a customer returns a product, the company will record the financial activity under the sales return account. They wouldn’t know any of that if you just subtracted depreciation and recorded only the asset’s net value. A contra asset account is paired with an asset and reduces its value.

Debit balances are normal for asset and expense accounts, and credit balances are normal for liability, equity and revenue accounts. Contra liabilities are not seen on a balance sheet as often as contra assets. Discount on bonds payable is a result of a bond issued for less than the face value of the bond. Companies must bring the balance of the discount on bonds payable account to zero over the life of the bond, which is accomplished through amortization. The amount recorded in the discount on bonds payable account is amortized to interest expense over the life of the bond.

Author: Kate Rooney