Content

77) Revenue and expense accounts are permanent accounts and should not be closed at the end of the accounting period. 64) An unadjusted trial balance is a list of accounts and balances prepared before adjustments are recorded. 22) A company paid $9,000 for a twelve-month insurance policy on February 1. A fire in the company’s warehouse that destroys inventory and assets is not recognized because the conditions did not exist prior to the balance sheet date. Cash management involves identifying the cash balance which allows for the business to meet day-to-day expenses, but reduces cash holding costs. The current ratio, which is the simplest measure and is calculated by dividing the total current assets by the total current liabilities.

Interim financial statements report a company’s business activities for a one-year period. Disclosure of accounting policy for reclassifications that affects the comparability of the financial statements. Disclosure of accounting policy for major classes of inventories, bases of stating inventories , methods by which amounts are added and removed from inventory classes , loss recognition on impairment of inventories, and situations in which inventories are stated above cost. If inventory is carried at cost, this disclosure includes the nature of the cost elements included in inventory.

- During 2017, the Company spent $33.0 billion to repurchase shares of its common stock and paid dividends and dividend equivalents of $12.8 billion.

- Sales of merchandise are recorded at the time of delivery to the customer and are reported net of merchandise returns.

- In a regular year-end calculation, comparison of monthly activity is often misleading because some months will have more weekends than others.

- Factors subject to change include the unspecified software upgrade rights and non-software services offered, the estimated value of unspecified software upgrade rights and non-software services and the estimated period unspecified software upgrades and non-software services are expected to be provided.

As of September 30, 2017, a significant portion of the Company’s trade receivables was concentrated within cellular network carriers, and its vendor non-trade receivables and prepayments related to long-term supply agreements were concentrated among a few individual vendors located primarily in Asia. While the Company has procedures to monitor and limit exposure to credit risk on its trade and vendor non-trade receivables, as well as long-term prepayments, there can be no assurance such procedures will effectively limit its credit risk and avoid losses. The Company has typically experienced higher net sales in its first quarter compared to other quarters due in part to seasonal holiday demand. Further, the Company generates a majority of its net sales from a single product and a decline in demand for that product could significantly impact quarterly net sales.

Changing A Companys Tax Year End

The Company has also invested in programs to enhance reseller sales by placing high-quality Apple fixtures, merchandising materials and other resources within selected third-party reseller locations. Through the Apple Premium Reseller Program, certain third-party resellers focus on the Apple platform by providing a high level of product expertise, integration and support services. The Company’s developer programs support app developers with building, testing and distributing apps for iOS, macOS, watchOS and tvOS. Developer program membership provides access to beta software and advanced app capabilities (e.g., CloudKit®, HealthKit™ and Apple Pay), the ability to test apps using TestFlight®, contra asset account distribution on the App Store, access to App Analytics and code-level technical support. Developer programs also exist for businesses creating apps for internal use and developers creating accessories for Apple devices . All developers, even those who are not developer program members, can sign in with their Apple ID to post on the Apple Developer Forums and use Xcode®, the Company’s integrated development environment for creating apps for Apple platforms. Xcode includes project management tools; analysis tools to collect, display and compare app performance data; simulation tools to locally run, test and debug apps; and tools to simplify the design and development of user interfaces.

These markets are highly competitive and include many large, well-funded and experienced participants. These markets are characterized by aggressive price competition, frequent product introductions, evolving design approaches and technologies, rapid adoption of technological and product advancements by competitors and price sensitivity on the part of consumers and businesses. The Company also sells its hardware and software products to enterprise and government Online Accounting customers in each of its reportable segments. The Company’s products are deployed in these markets because of their performance, productivity, ease-of-use and seamless integration into information technology environments. The Company’s products are compatible with thousands of third-party business applications and services, and its tools enable the development and secure deployment of custom applications as well as remote device administration.

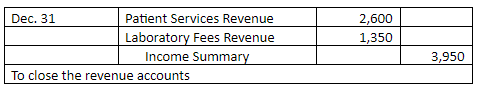

That is, assets are on the left side of the statement and liabilities and equity are on the right side of the statement. Earned but uncollected revenues that are recorded during the adjusting process with a credit to a revenue account and a debit to an expense account are referred to as accrued expenses. The first five steps in the accounting cycle include analyzing transactions, journalizing, posting, preparing an unadjusted trial balance and recording adjusting entries.

How Do I Pick A Fiscal Year End?

Further, the design of a control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative to their costs. Because of the inherent limitations in all control systems, no evaluation of internal controls can provide absolute assurance that all control issues and instances of fraud, if any, have been detected. Also, any evaluation of the effectiveness of controls in future periods are subject to the risk that those internal controls may become inadequate because of changes in business conditions, or that the degree of compliance with the policies or procedures may deteriorate.

The Company also records reductions to revenue for expected future product returns based on the Company’s historical experience. Future market conditions and product transitions may require the Company to increase customer incentive programs that could result in reductions to future revenue.

These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate.

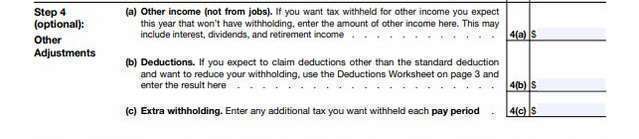

The default IRS system is based on the calendar year, so fiscal-year taxpayers have to make some adjustments to the deadlines for filing certain forms and making payments. While most taxpayers must file by April 15 following the year for which they are filing, fiscal-year taxpayers must file by the 15th day of the fourth month following the end of their fiscal year. Alternatively, instead of observing a 12-month fiscal year, U.S. taxpayers may observe a 52- to 53-week fiscal year. This system automatically results in some 52-week fiscal years and some 53-week fiscal years. Investopedia requires writers to use primary sources to support their work.

Unlike the other basic financial statements, the balance sheet only applies to a single point in time of the calendar year. The fiscal year—also sometimes referred to as the financial, tax, or accounting year—is the 12-month period a company’s fiscal year must correspond with the calendar year. of time that you, your accountant and the IRS use for financial reporting when your organization doesn’t use the standard calendar year. The adjusted trial balance lists the account balances segregated by assets and liabilities.

What Is The Fiscal Year 2019?

The matching principle and the full closure principle are the two main accounting principles used in accrual accounting. Buildings on leased land and leasehold improvements are amortized over the shorter of their economic lives or the lease term, beginning on the date the asset is put into use. Download our free marketing plan example to create a detailed plan for your business. Check out this sports apparel business plan sample to get your business start. This business project status report will help you keep an eye on project progress and goals. The change of year-end is applied for on IRS Form 1128, Application for Change in Accounting Period, which must be filed on or before the 15th day of the second calendar month following the close of the short period resulting from the desired change. Whether you manage your own books or hire someone else to do it, understanding these basic terms will help you run your business more effectively and make better-informed financial decisions.

Agreements entered into by the Company sometimes include indemnification provisions which may subject the Company to costs and damages in the event of a claim against an indemnified third party. In the opinion of management, there was not at least a reasonable possibility the Company may have incurred a material loss, or a material loss in excess of a recorded accrual, with respect to indemnification of third parties. The Company utilizes several outsourcing partners to manufacture sub-assemblies for the Company’s products and to perform final assembly and testing of finished products. These outsourcing partners acquire components and build product based on demand information supplied by the Company, which typically covers periods up to 150 days. The Company also obtains individual components for its products from a wide variety of individual suppliers. As of September 30, 2017, the Company expects to pay $37.6 billion under manufacturing-related supplier arrangements, substantially all of which is noncancelable.

The Company also employs a variety of indirect distribution channels, such as third-party cellular network carriers, wholesalers, retailers and value-added resellers. During 2017, the Company’s net sales through its direct and indirect distribution channels accounted for 28% and 72%, respectively, of total net sales.

The Company is committed to bringing the best user experience to its customers through its innovative hardware, software and services. The Company’s business strategy leverages its unique ability to design and develop its own operating systems, hardware, application software and services to provide its customers products and solutions with innovative design, superior ease-of-use and seamless integration. The Company also supports a community for the development of third-party software and hardware products and digital content that complement the Company’s offerings. The Company believes a high-quality buying experience with knowledgeable salespersons who can convey the value of the Company’s products and services greatly enhances its ability to attract and retain customers. Therefore, the Company’s strategy also includes building and expanding its own retail and online stores and its third-party distribution network to effectively reach more customers and provide them with a high-quality sales and post-sales support experience. The Company believes ongoing investment in research and development (“R&D”), marketing and advertising is critical to the development and sale of innovative products, services and technologies.

Components Of The Balance Sheet

The Company currently holds a significant number of patents and copyrights and has registered and/or has applied to register numerous patents, trademarks and service marks. In contrast, many of the Company’s competitors seek to compete primarily through aggressive pricing and very low cost structures, and emulating the Company’s products and infringing on its intellectual property.

There are numerous circumstances under which a contractor may wish to change its year-end, and the IRS makes it relatively simple to initiate these changes. However, the IRS does require that whatever year-end a company chooses to adopt be the same as its annual accounting period and that changes needing prior approval have a substantial business purpose. However, within these constraints, companies can use a change in year-end as a powerful planning tool. A fiscal year is an accounting period of 365 days that does not necessarily correspond to the calendar year beginning on January 1st. The fiscal year is the established period of time when an organization’s annual financial records commence and conclude. Fiscal quarters are consecutive three-month periods on a company’s financial calendar used as the basis for financial reporting and dividend payments. Paid, in advance, $3,000 for 6 months of Insurance Prepare the adjusting entry for JAN 31.

However, a subsequent event footnote disclosure should be made so that investors know the event occurred. Assume that, due to new technology, there is a significant reduction in the market price of Company A’s inventory. This will require an adjustment normal balance to the financial statements, with inventory valued at the lower of cost or market value. Attributing preferred shares to one or the other is partially a subjective decision, but will also take into account the specific features of the preferred shares.

Income Statement

Current assets are those assets which can either be converted to cash or used to pay current liabilities within 12 months. Current assets include cash and cash equivalents, short-term investments, accounts receivable, inventories and the portion of prepaid liabilities paid within a year. 10.The revenue recognition principle is the basis for making adjusting entries that pertain to unearned and accrued revenues. Book an appointment at Helping Hands Commercial Cleaning in 3 simple steps and get the best office cleaning in Illinois. The last four steps in the accounting cycle include preparing the adjusted trial balance, preparing financial statements and recording closing and adjusting entries. Prior to recording adjusting entries at the end of an accounting period, some accounts may not show proper financial statement amounts even though all transactions were correctly recorded.

The Consolidated Financial Statements include the accounts of Macy’s, Inc. and its 100%-owned subsidiaries and the newly established majority-owned subsidiary, Macy’s China Limited. The noncontrolling interest respresents the Fung Retailing Limited’s thirty-five percent proportionate share of the results of Macy’s China Limited. Trial Balance – Illustrations are based on the October 31, trial balance of Pioneer Advertising Agency Inc. Revenues received in cash and recorded as liabilities before they are earned.

In recent years software solutions have been developed to bring a level of process automation, standardization and enhanced control to the substantiation or account certification process. These solutions are suitable for organizations with a high volume of accounts and/or personnel involved in the substantiation process and can be used to drive efficiencies, improve transparency and help to reduce risk. D. Prepaid expenses, depreciation, and unearned revenues often require adjusting entries to record the effects of the passage of time.

Apple Inc. ends its fiscal year on the last business day of September and in 2018, fell on the 29th. It is common for nonprofit organizations to observe a Jul 1 to Jun 30 fiscal year. Fiscal years that vary from a calendar year are typically chosen due to the specific nature of the business. For example, nonprofit organizations typically align their year with the timing of grant awards. Companies have the ability to choose the best fiscal year-end for themselves, designed with the needs of the company in mind. Two main accounting principles used in accrual accounting are matching and full closure. 7.Two main accounting principles used in accrual accounting are matching and full closure.

The Company expects to execute its capital return program by the end of March 2019 by paying dividends and dividend equivalents, repurchasing shares and remitting withheld taxes related to net share settlement of restricted stock units. The Company plans to continue to access the domestic and international debt markets to assist in funding its capital return program. As of September 30, 2017, $166 billion of the share repurchase program had been utilized. Under the program, shares may be repurchased in privately negotiated or open market transactions, including under plans complying with Rule 10b5-1 under the Exchange Act. The year-over-year increase in Services net sales in 2016 was due primarily to growth from the App Store, licensing and AppleCare sales, partially offset by the effect of weakness in most foreign currencies relative to the U.S. dollar.

Accounting Terms All Business Owners Should Know

Because the Company’s markets are volatile, competitive and subject to rapid technology and price changes, there is a risk the Company will forecast incorrectly and order or produce excess or insufficient amounts of components or products, or not fully utilize firm purchase commitments. The Company records a write-down for product and component inventories that have become obsolete or exceed anticipated demand or net realizable value and accrues necessary cancellation fee reserves for orders of excess products and components.

The Company could also be subject to unexpected developments late in a quarter, such as lower-than-anticipated demand for the Company’s products, issues with new product introductions, an internal systems failure, or failure of one of the Company’s logistics, components supply, or manufacturing partners. Under payment card rules and obligations, if cardholder information is potentially compromised, the Company could be liable for associated investigatory expenses and could also incur significant fees or fines if the Company fails to follow payment card industry data security standards. The Company’s business also requires it to share confidential information with suppliers and other third parties.